The Foundations: Defining Employees and Contractors

Before dissecting the legal intricacies, it's crucial to understand the basic definitions:

Employees

An employee is an individual who works under an employment agreement, whether it be written, verbal, or implied. Employees are entitled to a range of rights and benefits, including sick leave, annual holidays, parental leave, and protection against unfair dismissal. Employers are also responsible for deducting tax and providing a safe working environment.

Contractors

Contractors, on the other hand, are considered self-employed individuals or entities who offer services on a contractual basis. They are not entitled to the same statutory rights and benefits as employees. Contractors are responsible for their own tax obligations, ACC (Accident Compensation Corporation) levies, and generally provide their own equipment.

Key Determinants in Classification

1. Control and Independence

One of the primary considerations in distinguishing between an employee and a contractor is the degree of control exerted by the employer. Employees are typically subject to a higher level of control, with employers dictating the work hours, location, and specific tasks. Contractors, on the contrary, have more autonomy in how they carry out their work.

2. Integration into the Business

Employees are often seen as integral components of a company's operations, whereas contractors are usually engaged for specific projects or tasks. Contractors might have multiple clients and work independently, whereas employees are more closely aligned with the employer's long-term objectives.

3. Financial Arrangements

Employees receive a regular salary or wage, with tax and other deductions made by the employer. They may also receive benefits such as superannuation contributions or health insurance. Contractors, on the other hand, invoice for their services and are responsible for their taxes, ACC levies, and other financial matters.

4. Provision of Tools and Equipment

Employees generally have their tools and equipment provided by the employer. Contractors, however, are typically responsible for providing their tools, machinery, and resources necessary to carry out their work.

Incoming Changes

Issues with uncertainty and potential unfairness in independent contracting relationships have been on the Government’s radar for some time, with different parties suggesting different ways to reform this area of law. Some businesses have misinterpreted the requirements of a contractor relationship, resulting in contractors being legally classified as employees who were denied their minimum employment entitlements. Consequently, these businesses have faced substantial fines.

The Government's decision to address these concerns was influenced by a recent Court of Appeal ruling that classified Uber drivers as employees. This ruling may set a precedent for workers in similar platform-based industries to challenge their employment status. In response, the Government has proposed amendments to limit such challenges.

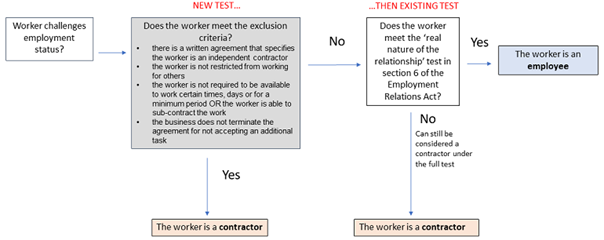

Gateway Test

The proposed legislative changes introduce a "gateway test" with four criteria that must all be met for a worker to be classified as a contractor:

The criteria are:

- A written agreement with the worker, specifying they are an independent contractor;

- The business does not restrict the worker from working for another business (including competitors);

- The business does not require the worker to be available to work on specific times of day or days, or for a minimum number of hours or the worker can sub-contract the work; and

- The business does not terminate the contract if the worker does not accept an additional task or engagement.

All four conditions must be met to achieve the final step of classifying the worker as an independent contractor. If not, the current test, which assesses the parties' intentions, control, integration, and economic reality to determine the "true nature" of their relationship, which is set out earlier in this article, will remain applicable—putting the parties back to square one. MBIE has provided a diagram that provides a helpful illustration on how the changes will work once the changes are implemented.

Once these changes take effect, business owners must ensure they meet all four criteria when engaging a contractor. This new framework is designed to provide businesses with confidence that they are complying with employment regulations while reducing the risk of misclassification claims.

Penalties for Misclassification

Misclassifying workers can have serious consequences for employers in New Zealand. If an employee is wrongly classified as a contractor, they may be entitled to recover unpaid holiday pay, sick pay, and other benefits. Additionally, employers may face penalties and fines for failing to meet their legal obligations.

Seeking Legal Guidance

Navigating the complexities of employment classifications can be daunting for businesses in New Zealand. Seeking legal advice is crucial to ensure that companies comply with the country's employment laws. It is essential businesses understand the difference between an employee and a contractor, which can be determined by various factors such as control, integration, financial arrangements, and provision of tools. By seeking legal counsel, companies can be confident that their employees are classified correctly, ultimately fostering a harmonious and legally sound work environment. At Burley Castle Hawkins Law, we provide sound legal advice to help you navigate this complex landscape and ensure compliance with employment laws.

The information contained in this article is provided for informational purposes only and should not be construed as legal advice on any subject matter.